Expense operations across borders

Managing expenses for operations across an entire continent can be intricate. Deeply rooted in Europe, our compliance to GDPR and adherence to each country's local regulations act as your multi-national guardian. Experience a seamless transition between different regulatory frameworks while ensuring data security.

PCI DSS, ISAE 3402 and ISO 27001 certified

Streamlining expenses for European businesses

Empowering Finance Managers across the EU

Mobilexpense is your digital gateway to simplified expense management across Europe. Our comprehensive mobile app eliminates outdated, paper-based methods while ensuring complete alignment with international standards. Embrace productivity and efficiency, and walk the path of digitisation with Mobilexpense.

- Digital, paperless expense management across European countries.

- Comprehensive mobile app which adheres to international standards.

- Path to increased productivity and operational efficiency.

.png?width=800&height=633&name=%5BMarkets%5D%20Local%20(ENG).png)

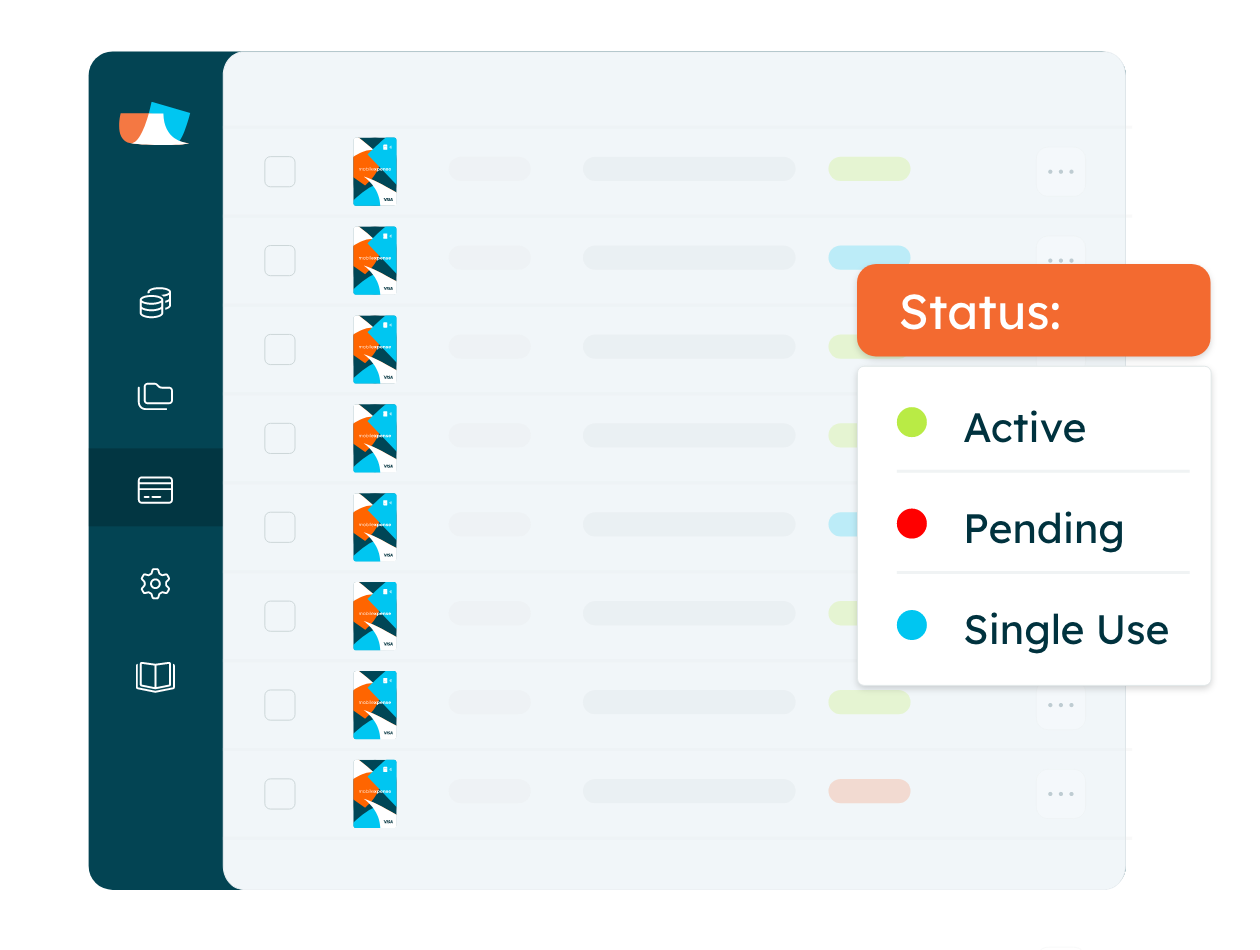

Control your finances, wherever you operate

Mobilexpense integrates seamlessly with your company cards, offering real-time notifications for every expense. It's like having an omnipresent financial assistant, optimising resource allocation and ensuring alignment with European regulations.

Remain in control of your expenses, no matter where you operate within the EU.

- Seamless integration with company cards used across the EU.

- Real-time notifications for every expense, even abroad.

- Remain in control, regardless of your EU operational boundaries.

65%

Time saved

Easier expense process by automating manual tasks such as data entry and sorting receipts.

3.000+

Satisfied customers

Make better decisions with digitised processes and concentrate on more important work.

1,7M

App downloads

Let your employees declare their expenses on the go with a simple photo and the help of our OCR engine.

Embrace simplicity and speed

Mobilexpense offers a unique blend of speed and ease of implementation. Our Customer Success team guides you through each step, from managing settings to defining data export options, across all your EU operations.

Find out how Mobilexpense can boost your financial operations.

- Discover the ease of implementation across multiple EU countries.

- Enhance operational efficiency and gain control over expenses, EU-wide.

- Explore the transformative potential of Mobilexpense for your continental operation.

.png?width=800&height=677&name=%5BSolution%5D%20Travel_Business%20trip%20(ENG).png)

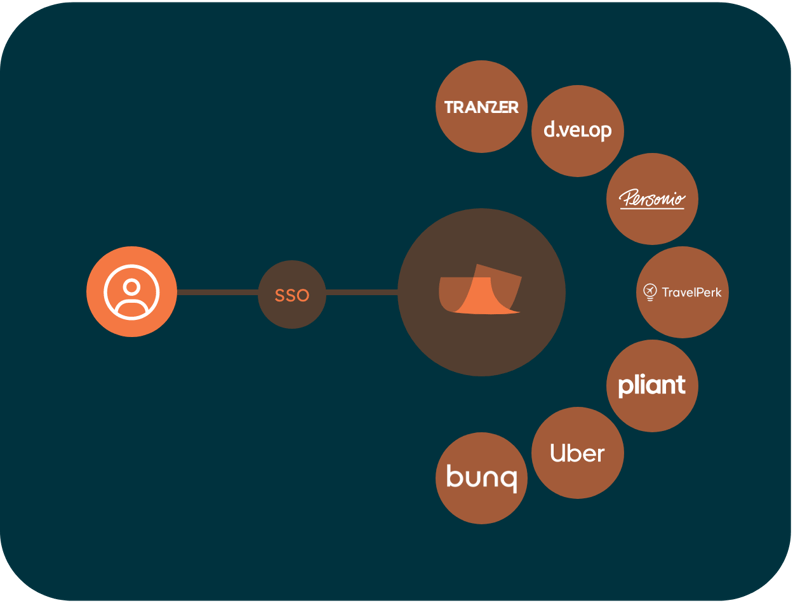

The power of connectivity

Connect Mobilexpense to your existing HR, ERP, and accounting tools for a unified financial software ecosystem that simplifies cross-border operations.

The power of connectivity enables a cohesive financial framework across your EU operations, simplifying processes, enhancing security, and maintaining national compliance.

- Seamless integration with existing HR and financial software for cross-border operations.

- Simplified processes, enhanced security across the EU.

- Cohesive financial framework ensuring compliance in every country of operation.

Take full control with all your tools in one place

GDPR compliant

We are GDPR compliant and our data centres are located in Europe.

Personalised support

All our customers benefit from free, personalised support and guidance.

Multiple entities

Switch and manage multiple expense entities based on defined roles.

Automated mileages

Daily allowances

Rules & workflows

Expense policies

Multilingual support

Single Sign On

Mobile & desktop apps

Accounting & ERP connection

Data export

Hear what they have to say

"Mobilexpense has almost become an invisible system for us. We hardly need to pay attention to it and yet it works to everyone’s satisfaction."

Henrik Ahtela

Finance Systems and Process Manager, Proximus

Frequently asked questions

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi.